Agreements of significance to Enea Capital Group operations

In 2015 Enea Capital Group companies did not conclude any significant agreements, i.e. agreements with the value exceeding 10% of Enea's equity, yet in the reporting period an annex was concluded to the annual agreement from 2014 for the supplies of fuel coal between Enea Wytwarzanie and LW Bogdanka. Pursuant to the annex, detailed prices were specified for basic coal supplies in 2015 to Kozienice Power Plant as a result of which the value of the aforementioned annual agreement for coal supplies in 2015 changed and currently amounts to PLN 766 mln.

On 21 August Enea Wytwarzanie submitted a notice to LW Bogdanka regarding termination of the Multiannual Agreement for supplies of fuel coal concluded on 4 March 2010 at 2 months’ notice period effective as of 1 January 2016. As a consequence of the termination notice filed by Enea Wytwarzanie regarding the Multiannual Agreement, the agreement will be terminated on 1 January 2018. The subject of the Multiannual Agreement were fuel coal supplies from LW Bogdanka to Enea Wytwarzanie in the period from 4 March 2010 to 31 December 2025. The Multiannual Agreement was terminated by Enea Wytwarzanie due to lack of agreement between the parties as regards coal prices for 2016 within the term foreseen in the Multiannual Agreement, and also due to the Multiannual Agreement's terms which are unfavourable to Enea Wytwarzanie and which do not correspond to the current situation on the fuel coal market.

Continuation of activities with the implementation of the corporate strategy for 2014 - 2020 and investment financing

| Date of agreements | Parties to the agreement | Description | |

|---|---|---|---|

| 21 September 2012 | Enea Wytwarzanie sp. z o.o. | Hitachi Power Europe GmbH i Polimex-Mostostal SA | Agreement for the construction of a new power unit in Kozienice - planned completion of the investment: July 2017 |

| 23 July 2015 | Enea SA | PKO BP SA, Bank Pekao SA, Bank Zachodni WBK SA, Bank Handlowy w Warszawie SA | Annex to the Programme Agreement of 21 June 2012 amending the terms of financing in the amount up to PLN 3 billion |

| 3 December 2015 | Enea SA | Bank Gospodarstwa Krajowego | Programme Agreement in the amount of up to PLN 700 mln with allocation to investment needs financing |

| 22 July 2014 | Enea Wytwarzanie sp. z o.o. | Mitsubishi Hitachi Power Systems | Agreement for the installation of flue gases denitrification plant for 2 units in Kozienice power plant. The investment will allow to reduce the nitric oxides emission by 80%. The investment completion is planned for May 2016 |

| 29 May 2015 | Enea SA | European Investment Bank | Financial agreement for the amount of PLN 946 mln |

Agreements on coal supplies and transportation

Agreements concluded by Enea Wytwarzanie sp. z o.o.

| Date of conclusion | Party to the agreement | Description |

|---|---|---|

| 4 March 2010 | LW Bogdanka SA | Multiannual agreement - specifies the general terms of coal supplies in 2010-2025 |

| 15 January 2014 | Annual Agreement for supplies of fuel coal in 2015 - completed | |

| 3 December 2014 | Katowicki Holding Węglowy SA | Multiannual agreement - specifies the general terms of coal supplies in 2015-2017 |

| 3 December 2014 | Annual Agreement for supplies of fuel coal in 2015 | |

| 21 March 2014 | Jastrzębska Spółka Węglowa SA | The Agreement relates to coal supplies in 2014-2015 |

| 31 March 2015 | Coal supply agreement - specifies the terms of coal supplies in 2015-2017 | |

| 12 January 2015 | Kompania Węglowa SA | Coal supply agreement - specifies the detailed terms of coal supplies in 2015-2016 |

| 17 June 2015 | PKP Cargo SA | Performance of fuel coal transportation services for Enea Wytwarzanie from LW Bogdanka SA until 31 July 2016 (or until the utilisation of the volume of 3,600,000 t) |

Insurance contracts

Insurance agreements in Enea Group are concluded in accordance with the corporate Insurance Policy. Due to the common Policy insurance standards were standardised in the Group and insurance protection acquisitions were consolidated obtaining indicative benefits as regards the premium and insurance coverage.

Enea Group Companies transfer the risk of incurring losses as a result of property damage and third party claims through conclusion of insurance agreements with largest insurance agencies such as PZU SA, TUiR WARTA SA, STU Ergo Hestia SA, TU Allianz Polska SA.

Because of a great exposure of Enea Group Companies to damage and potential claims it may not be ruled out that the concluded insurances are insufficient. The insurance coverage level does not diverge from the standards applied in the Polish electrical power industry and is adjusted to the specifics of operations of particular companies.

Agreements between shareholders of the parent company

The Company is not aware of any agreements between shareholders of Enea SA.

Collaboration or cooperation agreements

The letter of intent regarding cooperation in the research and development projects

Based on the letter of Intent of 2014 concluded between Enea SA, PGE Polska Grupa Energetyczna SA, ENERGA SA and TAURON Polska Energia SA, in 2015 its signatories continued the operations led by the Polish Electricity Association (PEA), whose goal is to establish by the National Centre for Research and Development (NCRD) a sectoral programme for power engineering (SP) - research and development works financing programme.

Continuation of the cooperation in the project of preparation for the construction of the first atomic power plant in Poland

On 3 September 2014 Enea, PGE, TAURON and KGHM concluded the Shareholder Agreement.

Pursuant to the Agreement, Enea, TAURON and KGHM as Business Partners will purchase a total of 30% of shares (each Business Partner will acquire 10% of shares) in the special purpose vehicle - PGE EJ 1 from PGE, based on a separate Share Purchase Agreement.

On 15 April 2015 Enea, PGE, TAURON and KGHM concluded the Share Purchase Agreement for shares in PGE EJ 1. The companies purchased 10% of shares each from PGE (a total of 30% of shares) in PGE EJ 1. Enea paid PLN 16 mln for the purchased shares.

On 29 July 2015 the Extraordinary General Meeting of Shareholders of PGE EJ 1 was held during which the Shareholders decided to raise the share capital of the Company by ca. PLN 70 mln, through the issue of 496,450 new shares of the nominal value of PLN 141 each, subscribe for the newly created shares and cover them with cash contribution. Pursuant to the decision of the EGM Enea took up 49,645 shares of the total nominal value of ca. PLN 7 mln and covered them with cash totalling to ca. PLN 7 mln.

The Parties undertook, pursuant to the Shareholder Agreement and proportionally to the number of shares held, to finance the activities being part of the Preliminary Stage of the project.

The Preliminary stage is to specify such elements as:

- potential partners, including the strategic partner

- technology providers, EPC contractors (Engineering, Procurement, Construction)

- atomic fuel supplier

- obtaining financing for the project

- organisational and competence-related preparation of PGE EJ 1 for the role of the future operator of the atomic power plant, responsible for its safe and efficient exploitation (Integrated Proceedings).

Pursuant to the Shareholder Agreement, the financial commitment of Enea SA during the Preliminary Stage will not exceed the amount of ca. PLN 107 mln and is to based on making contributions, up to this amount, for the raised share capital of PGE EJ 1.

The Parties to the Shareholder Agreement continue the cooperation within the undertaking and foresee that the decision relating to the declaration of further participation of particular Parties in the next stage of the project will be made after the completion of the development stage, directly before making the final decision within the Integrated Proceedings.

Financing sources of the investment programme

Enea SA finances the investment programme using financial surpluses from the conducted business operations and external debt. Enea Capital Group realises the investment financing model in which Enea SA obtains external funding and distributes it to its subsidiaries.

Programme Agreement on the bond issue programme up to the amount of PLN 3 billion

Enea SA holds the programme agreement relating to the bond issue programme up to the amount of PLN 3 billion with banks operating as Underwriters, i.e.: PKO BP SA, Bank Pekao SA, BZ WBK SA and Bank Handlowy w Warszawie SA. The financing is not hedged on Enea Capital Group’s assets.

The funds obtained from the programme are allocated to the realisation of investment projects in Enea Group, including e.g. for the construction of the 1,075 MWe gross supercritical bituminous coal fired power unit, which is being constructed as a part of Enea Wytwarzanie's operations.

On 23 July 2015, Enea SA concluded an Annex to the Agreement which amended the financing conditions adapting them to the current market situation and amended the legal basis for the issue of new series of bonds to the Bond Act of 15 January 2015.

On 18 December 2015, Enea SA issued another tranche of five-year bonds with a floating rate interest (WIBOR plus margin) for the amount of PLN 341 maturing after 5 years.

As at 31 December 2015 the value of the bonds issued within the aforementioned Programme totalled to PLN 1,201 mln.

![]()

Programme Agreement on the bond issue programme up to the amount of PLN 5 billion

On 30 June 2014, Enea SA concluded a programme agreement relating to the bond issue programme up to the amount of PLN 5 billion with five banks acting as dealers: ING Bank Śląski SA, PKO BP SA, Bank Pekao SA and mBank SA. As a part of the Programme Enea may issue bonds with the maturity of up to 10 years, and Bank dealers have the duty of care when offering the sale of bonds to market investors. The first series of bonds in the amount of PLN 1 billion was issued in February 2015. The first series bonds are registered with the National Depository for Securities and are listed on the alternative trading system on Catalyst.

On 7 September 2015 an annex was signed to the said Agreement which amended the legal basis of the issue of successive series of bonds to the Bond Act dated 15 January 2015.

On 16 September 2015, Enea SA issued 6-year bonds in the total amount of PLN 500 mln for one investor. The interest rate is based on floating WIBOR rate increased with the margin.

![]()

The Programme Agreements on the bond issue programme guaranteed by BGK

On 15 May 2014, Enea SA concluded a programme agreement relating to the bond issue programme up to the amount of PLN 1 billion guaranteed by Bank Gospodarstwa Krajowego. The financing is not hedged on Enea Capital Group’s assets. The funds from that programme are allocated e.g. to the realisation of the investments by Enea SA and its subsidiaries.

On 1 September an annex was signed to the subject Agreement which amended the legal basis of the issue of successive series of bonds to the Bond Act dated 15 January 2015.

As at 31 December 2015, Enea SA issued bonds in the said Programme of the total value of the Programme being PLN 1 billion. The bond redemption period is maximally 12.5 years from the date of their issue. The interest rate is based on floating WIBOR rate increased with the margin.

On 3 December 2015, Enea SA concluded another programme agreement relating to the bond issue programme up to the amount of PLN 700 million guaranteed by Bank Gospodarstwa Krajowego. The funds from that programme are allocated e.g. to the realisation of the investments and financing the current operations of Enea SA and its subsidiaries.

![]()

Investment loans granted by the European Investment Bank

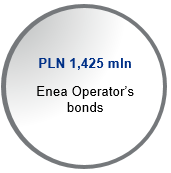

On 18 October 2012, Enea SA concluded a financial agreement with the European Investment Bank (EIB) based on which the Company was granted a loan in the amount of PLN 950 mln or its equivalent in EUR (tranche A). On 19 June 2013, another loan agreement (tranche "B") was concluded with EIB for the amount of PLN 475 mln. The funds in the total amount of PLN 1,425 mln obtained from the loan are designated for the financing of a multiannual investment plan regarding the modernisation and extension of the power grids of Enea Operator. The loan repayment period is up to 15 years from the planned disbursement of the facility.

As at 31 December, within "A" and "B" tranches, Enea SA drew funds from the loan in full, i.e. in the amount of PLN 1,425 mln in 4 separate amounts paid out from September 2013 to July 2015. The currency of the disbursed loan is Polish zloty, floating rate, based on WIBOR rate for 6-month deposits, increased with the Bank's margin. In the case of one disbursement the interest rate was based on the flat interest rate.

On 29 May 2015 another loan agreement was concluded based on which EIB provided the Company with new financing in the amount of PLN 946 mln or its equivalent in EUR (tranche “C”). The funds obtained from the loan will be designated for the financing of a multiannual investment plan in order to modernise and extend the power infrastructure of Enea Operator. The financing is not hedged on Enea Capital Group’s assets. In July 2015 the first amount was drawn from that loan totalling to PLN 100 mln.

The interest rate is floating based on WIBOR rate for 6-month deposits increased with a margin. The tranches will be paid in instalments, and the final repayment will be made in June 2030.

![]()

Financing sources of LW Bogdanka investment programme

The Programme Agreements on the bond issue programme of LW Bogdanka SA

LW Bogdanka SA holds two bond issue programmes up to the total amount of PLN 900 mln. Within the first Programme Agreement concluded with Bank Pekao SA LW Bogdanka SA issued bonds of the total value of PLN 300 mln. The redemption date is in 2018. The interest rate of the bonds is based on WIBOR 3M rate increased with the fixed margin. The other Programme Agreement was concluded on 30 June 2014 with Bank Pekao SA and Bank Gospodarstwa Krajowego up to the total amount of PLN 600 mln, which is divided into 2 tranches, PLN 300 mln each. As at 31 December 2015 the bonds were issued of the total amount of PLN 400 mln with the redemption date on 30 June 2016. The issue programme foresees that LW Bogdanka SA has the right to issue subsequent bond series within a given tranche to refinance the previous issue of a given tranche (roll-out), which justifies the long-term nature of the Bond Issue Programme. The term of the Programme Agreement expires on: for Tranche 1 - 31 December 2019, for Tranche 2 - 31 December 2020. The interest rate of bonds is based on WIBOR 3M rate incre

![]()

Enea SA's further actions will concentrate on guaranteeing the appropriate level of diversification of external financing sources for investments planned in Enea Capital Group Strategy in order to optimise the amount of costs and dates of debt repayment.

Issue of Enea SA's securities in 2015

| Date of issue | Type of issue | Value of issue [PLN '000] |

|---|---|---|

| 10 February 2015 | Non-public market issue as part of the Programme Agreement relating to the bond issue programme up to the amount of PLN 5 billion | 1.00 |

| 9 September 2015 | Non-public issue as part of the Programme Agreement relating to the bond issue programme up to the amount of PLN 1 billion guaranteed by BGK bank | 0.74 |

| 16 September 2015 | Non-public private placement issue as part of the Programme Agreement relating to the bond issue programme up to the amount of PLN 5 billion | 0.50 |

| 18 December 2015 | Non-public issue within the Programme Agreement relating to the bond issue programme up to the amount of PLN 3 billion guaranteed by a consortium of banks - PKO BP SA, Pekao SA, BZ WBK SA and Bank Handlowy w Warszawie SA | 0.341 |

| TOTAL | 2.581 |

The nominal debt for the bonds issued by Enea SA as at 31 December 2015 totalled to PLN 3.701 billion.

Transactions hedging the interest rate risk in 2015

Implementing the Interest Rate Risk Management Policy Enea SA concluded transactions in 2015 which hedge the interest rate risk (Interest Rate Swap) for the total equivalence of the debt in the amount of PLN 2,995 mln. The concluded transactions hedge the level of settlements and payments resulting from the debt through the permanent change of variable interest streams.

Use of proceeds from the issue of securities

The funds obtained by Enea SA from the bond issue are used on the implementation of real and equity investments conducted by Subsidiaries.

Enea Wytwarzanie has been constructing the most modern power unit in Poland in Świerże Górne. All the issues performed by Enea Wytwarzanie in 2015 were devoted to financing the expenses associated with the project.

The funds obtained by Enea SA in September 2015 from bond issue in the amount of PLN 500 mln and PLN 740 mln were devoted for the purchase of LW Bogdanka SA.

Assessment of the Feasibility of Implementing Investment Plans

The Company’s financial standing gives strong bases to implement investment plans. The balance sheet, equity and balance of cash of Enea Capital Group provide a solid base for capital expenditures financing, both from our own resources and external sources. In order to use its resources efficiently, in their further investment activities (particularly in the area of acquisitions) the Company intends to make use of debt financing so as to attain leverage.

Distribution of cash - subsidiaries’ bond Issue programmes

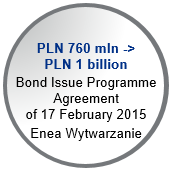

On 17 February 2015, Enea Wytwarzanie, Enea and PKO Bank Polski concluded the Bond Issue Programme Agreement for the amount of PLN 760 mln. Pursuant to the agreement, the Issuer has the right to issue bonds until 31 December 2015 on not more than 5 dates up to the total amount of PLN 760 mln. On 3 June 2015 an annex was concluded to the Bond Issue Programme for the amount of PLN 760 mln, base on which the parties increased the value of the Programme to PLN 1 billion and amended the provisions of the Agreement so that to enable Enea Wytwarzanie to issue bonds, both at interest floating and fixed rate.

On 17 February 2015, Enea Wytwarzanie, Enea and PKO Bank Polski concluded the Bond Issue Programme Agreement for the amount of PLN 760 mln. Pursuant to the agreement, the Issuer has the right to issue bonds until 31 December 2015 on not more than 5 dates up to the total amount of PLN 760 mln. On 3 June 2015 an annex was concluded to the Bond Issue Programme for the amount of PLN 760 mln, base on which the parties increased the value of the Programme to PLN 1 billion and amended the provisions of the Agreement so that to enable Enea Wytwarzanie to issue bonds, both at interest floating and fixed rate.

As at 31 December 2015, Enea Wytwarzanie issued bonds in the said Programme of the total value of PLN 1 billion.

On 29 July Enea took up the issue of the last series of bonds issued by Enea Operator within the Programme Agreement relating to the Bond Issue Programme up to the amount of PLN 1,425 mln dated 20 June 2013. The amount of the issued series totalled to PLN 375 mln. The bonds bear a fixed rate interest. The bonds will be redeemed in instalments, and the final redemption date is in June 2030,

On 29 July Enea took up the issue of the last series of bonds issued by Enea Operator within the Programme Agreement relating to the Bond Issue Programme up to the amount of PLN 1,425 mln dated 20 June 2013. The amount of the issued series totalled to PLN 375 mln. The bonds bear a fixed rate interest. The bonds will be redeemed in instalments, and the final redemption date is in June 2030,

On 11 February 2015, Enea Wytwarzanie, Enea and PKO Bank Polski concluded an annex to the Programme Agreement of 12 August 2014 relating to the Bond Issue Programme up to the amount of PLN 260 mln. Pursuant to the annex, the Parties increased the value of the Bond Issue Programme to PLN 1 billion and the possible number of bond issues within the Programme was increased to 8, and the expiry date of the Programme availability was set on 31 December 2016. The other terms of the programme remained unchanged. Changes which were made to other bond issue programmes resulted in the conclusion on 30 December 2015 of another annex to the Programme Agreement which decreased the Programme’s Value to PLN 260 mln again.

On 11 February 2015, Enea Wytwarzanie, Enea and PKO Bank Polski concluded an annex to the Programme Agreement of 12 August 2014 relating to the Bond Issue Programme up to the amount of PLN 260 mln. Pursuant to the annex, the Parties increased the value of the Bond Issue Programme to PLN 1 billion and the possible number of bond issues within the Programme was increased to 8, and the expiry date of the Programme availability was set on 31 December 2016. The other terms of the programme remained unchanged. Changes which were made to other bond issue programmes resulted in the conclusion on 30 December 2015 of another annex to the Programme Agreement which decreased the Programme’s Value to PLN 260 mln again.

As at 31 December 2015 the value of the bonds issued within the aforementioned Programme totalled to PLN 260 mln.

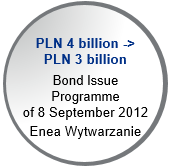

On 21 January 2015, an annex was concluded between Enea Wytwarzanie and mBank to the programme agreement relating to the Bond Issue Programme of 8 September 2012 pursuant to which the value of the Programme Agreement was decreased from PLN 4 billion to PLN 3 bln. An annex to the agreement guaranteeing the subscription by Enea for bonds issued by Enea Wytwarzanie was concluded on 21 January 2015 by Enea and Enea Wytwarzanie, along with the annex to the aforementioned agreement. Pursuant to the annex the value of the Enea Wytwarzanie's bonds, whose subscription by the Company is guaranteed, was adjusted to the current value of the Programme and reduced to the amount of PLN 3 bln. On 18 September 2015 another annex was concluded based on which the financial conditions were amended for newly issued bonds.

On 21 January 2015, an annex was concluded between Enea Wytwarzanie and mBank to the programme agreement relating to the Bond Issue Programme of 8 September 2012 pursuant to which the value of the Programme Agreement was decreased from PLN 4 billion to PLN 3 bln. An annex to the agreement guaranteeing the subscription by Enea for bonds issued by Enea Wytwarzanie was concluded on 21 January 2015 by Enea and Enea Wytwarzanie, along with the annex to the aforementioned agreement. Pursuant to the annex the value of the Enea Wytwarzanie's bonds, whose subscription by the Company is guaranteed, was adjusted to the current value of the Programme and reduced to the amount of PLN 3 bln. On 18 September 2015 another annex was concluded based on which the financial conditions were amended for newly issued bonds.

On 18 December 2015 Enea Wytwarzanie issued another tranche of five-year bonds with a floating rate interest. As at 31 December 2015, Enea Wytwarzanie issued bonds in the said Programme of the total value of PLN 1,201 mln.

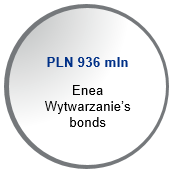

On 15 July Enea Wytwarzanie issued another series of bonds of the nominal value of PLN 936 mln. The issue was paid for via the set-off of claims to Enea Wytwarzanie due to the redemption of bonds of previous series issued by Enea Wytwarzanie. The issue’s purpose was maintaining by Enea Wytwarzanie of the availability of funds used for the realisation of the investment, including for financing the construction of the power unit No B-11 in Kozienice Power Plant and other investment needs of this Company.

On 15 July Enea Wytwarzanie issued another series of bonds of the nominal value of PLN 936 mln. The issue was paid for via the set-off of claims to Enea Wytwarzanie due to the redemption of bonds of previous series issued by Enea Wytwarzanie. The issue’s purpose was maintaining by Enea Wytwarzanie of the availability of funds used for the realisation of the investment, including for financing the construction of the power unit No B-11 in Kozienice Power Plant and other investment needs of this Company.

On 7 July an Executive Bond Issue Programme Agreement for the amount of PLN 946 mln between Enea as guarantor, Enea Operator as issuer and PKO Bank Polski as agent. Within the agreement Enea Operator may perform up to 10 issues of bonds until 17 March 2017. The bond redemption date - in instalments, however not later than within 15 years of the date of issue. The bonds may bear the fixed rate or floating rate interest based on WIBOR rate plus ma, with the interest rate revision after or 5 years.

On 7 July an Executive Bond Issue Programme Agreement for the amount of PLN 946 mln between Enea as guarantor, Enea Operator as issuer and PKO Bank Polski as agent. Within the agreement Enea Operator may perform up to 10 issues of bonds until 17 March 2017. The bond redemption date - in instalments, however not later than within 15 years of the date of issue. The bonds may bear the fixed rate or floating rate interest based on WIBOR rate plus ma, with the interest rate revision after or 5 years.

As at 31 December 2015, Enea Wytwarzanie issued bonds in the said Programme of the total value of PLN 100 mln. The bonds bear a fixed rate interest.

Credit and loan agreements concluded and completed

Enea SA, according to the nominal debt as at 31 December 2015, had loans in the amount of PLN 1,525,000 thou., including borrowings drawn by Enea SA in 2015:

| Start date | End date | Creditor | Amount of credit granted [PLN '000] | Interest rate | Credit debt as at 31 December 2015 [PLN '000] | Repayment period |

|---|---|---|---|---|---|---|

| 29 May 2015 | 31 March 2032 | (C) European Investment Bank | 946 0000 | base rate + margin | 100 000 | principal instalments determined on the loan tranche release |

| 19 June 2013 | 31 December 2030 | (B) European Investment Bank | 375 000 | base rate + margin | 375 000 | principal instalments determined on the loan tranche release |

| TOTAL | 475 000 |

Credits and loans drawn in 2015 by Enea Group Companies in 2015

In December 2015 Enea Wytwarzanie sp. z o.o. concluded a financing agreement in the form of a loan from the National Fund of Environmental Protection and Water Management for the amount of PLN 60,075 thou. in relation to the undertaking titled “Construction of the flue gas desulphurisation plant for K7 and K8 boilers in Białystok Heat and Power Plant”. The loan was granted for the period from April 2016 to December 2026, WIBOR 3M interest rate, repayment in quarterly instalments. The first release is planned on the turn of April and June 2016. In October 2015 Miejska Energetyka Cieplna Piła sp. z o.o. concluded a financing agreement in the form a loan from the Provincial Fund for Environmental Protection and Water Management for the amount of PLN 385 thou. for the realisation of the Company’s investment.

The total amount of the debt due to the loans and credits drawn by Enea SA and Enea Capital Group Companies as at 31 December 2015 amounted to PLN 1,586,773 thou. nominally.

Loans granted

As regards the loans granted by Enea SA to the companies within Enea Capital Group, the total indebtedness as at 31 December 2015 amounted to PLN 69,588 thou.

The information on the loan agreements concluded in 2015 by Enea SA and the level of their utilisation is presented in the table below:

| Date of granting | Date of complete repayment | Company | Amount of loan granted [PLN '000] | Interest | Debt on loans as at 31 December 2015 [PLN '000] |

|---|---|---|---|---|---|

| 19 January 2015 | 31 January 2020 | Enea Oświetlenie sp. z o.o. | 10 000 | WIBOR 1M + margin | 8 174 |

| 12 February 2015 | 31 July 2016 | Szpital Uzdrowiskowy Energetyk sp. z o.o. | 260 | WIBOR 1M + margin | 160 |

| 23 March 2015 | 31 December 2015 | Hotel Edison sp. z o.o. | 150 | WIBOR 1M + margin | 0 |

| 22 December 2015 | 30 June 2025 | Enea Centrum sp. z o.o. | 90 000 | None | 0 |

| TOTAL | 100 410 | 8 334 |

Granted and received sureties

The list of suretyships granted in 2015 by Enea SA is presented in the table below

| Date surety/ guarantee was granted | Date of validity of surety / guarantee | Entity for which surety / guarantee was granted | Entity to which surety / guarantee was granted | Amount of security granted [PLN '000] | Designation of amounts covered with surety/guarantee |

|---|---|---|---|---|---|

| 8 October 2015 | 8 October 2018 | Enea Trading sp. z o.o. | ČEZ a.s. | 10 000 | as the collateral for liabilities incurred by Enea Trading resulting from Individual Agreements relating to the sale and purchase of electricity |

| 26 October 2015 | 26 October 2018 | Enea Trading sp. z o.o. | Zespół Elektrowni Pątnów-Adamów-Konin SA | 24 000 | as the collateral for liabilities incurred by Enea Trading resulting from Individual Agreements relating to the sale and purchase of electricity |

| 26 October 2015 | 26 October 2018 | Enea Trading sp. z o.o. | Elektrownia Pątnów II sp. z o.o. | 8 000 | as the collateral for liabilities incurred by Enea Trading resulting from Individual Agreements relating to the sale and purchase of electricity |

| 27 October 2015 | 27 October 2018 | Enea Trading sp. z o.o. | PGE Polska Grupa Energetyczna SA | 20 000 | as the collateral for liabilities incurred by Enea Trading resulting from Individual Agreements relating to the sale and purchase of electricity |

| 28 December 2015 | 1 January 2018 | Enea Trading sp. z o.o. | PKN Orlen SA | 15 000 | as the collateral for liabilities incurred by Enea Trading resulting from Individual Agreements relating to wholesale trading in gaseous fuel |

The total off-balance sheet value of sureties granted as at 31 December 2015 was PLN 199,014.8 thou.

Granted and received guarantees

The total off-balance sheet value of bank guarantees granted on order of Enea SA as at 31 December 2015 was PLN 38,676.2 thou.

Guarantees granted on order of Enea SA in 2015 amounted to PLN 51,142 thou. Information on the greatest guarantees granted in 2015 is presented below.

| Date collateral was granted | Date of collateral validity | Entity for which collateral was granted | Purpose of the agreement | Form of collateral | Value of collateral granted [PLN thou.] |

|---|---|---|---|---|---|

| 1 January 2015 | 31 December 2015 | Polskie Sieci Energetyczne SA | collateral for liabilities relating to rendering electricity transmission services | bank guarantee granted within the guarantee line in the amount of PLN 100 000 thou. | 15 000 |

| 29 June 2015 | 31 May 2018 | Izba Rozliczeniowa Giełd Towarowych (Warsaw Commodity Clearing House) | making a margin deposit and transaction deposit for IRGiT | bank guarantee granted within the guarantee line in the amount of PLN 350 000 thou. | 15 000 |